How does Term Life Insurance work?

websitebuilder • December 30, 2020

Request Quote

Term life insurance works by providing coverage for a set “term” of time.

The fundamental feature of this type of life insurance is the “term” or length of time the policy is in-force. Typical terms are 10, 20 or 30 years. As long as you pass away while the policy is in-force the death benefit would be paid directly to your beneficiary(s).

Term life insurance protects families when they are most vulnerable. For instance, parents that have young kids may want coverage until their children graduate from school. Or, a family that just bought a house may want protection until their home loan is paid off.

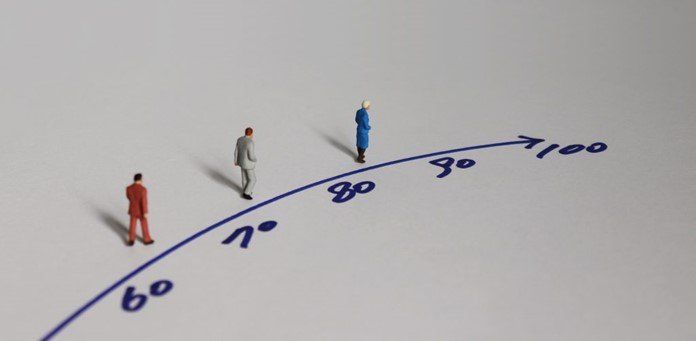

If a person outlives their policy term, the insurance ends and they must buy another policy. Unfortunately, the premium will be more expensive since that person is older and the insurer will consider health issues and medical history.

Who Needs Term Life Insurance?

Term life insurance is usually purchased to replace your income if you die. The proceeds from the policy will help your loved ones pay debts and living expenses.

For example, if you are a homeowner and you were to die suddenly, your spouse would have to pay the mortgage on his or her own. If you have enough coverage, the policy’s death benefit will pay off – or at least maintain the mortgage payment.

Additional reasons for Term Life Insurance –

- Family members/spouse who need your income

- You have children or are planning to have them

- You have significant debt – mortgage, student loans, etc.

- Financial legacy for your family

Ultimately, life insurance is put in place for your beneficiary(s) financial security.

How Much Coverage Do I Need?

The prevailing thought on this is to have 5 to 10 times your income in coverage. The term length should span most of your major financial obligations – maybe until the house is paid off or your children are grown.

The purpose of Term Life Insurance is to prevent a financial burden in the case something unexpected would happen. As a result, the coverage should account for living expenses like-

- rent or mortgage

- utilities (gas, water, etc.)

- childcare

- credit card debts

- additional bills

After choosing a term length and amount of coverage, there will be a monthly or annual payment for the length of that policy.

How Much Can I Expect to Pay for Term Life?

The price of your policy will vary depending on your age, health and other risk factors. The younger you are when you begin the policy, the more cost effective it will be.

For example-

A healthy male age 35 may qualify for $250,000 of Term Life insurance for $20.13 a month. A very reasonable premium for most families to budget for. According to LIMRA

, 80% of consumers misjudge the cost of Term Life insurance.

Choosing the Right Term Life Policy

Determining what “term” of time you should get (typically 10, 20 or 30 years) will require an analysis of your financial situation.

Some questions to answer are –

- When will my obligations change?

- When will my dependents be out on their own?

- What are my debts, loans or mortgage?

When purchasing life insurance you should always thoroughly examine your circumstances. Look closely at your present situation and review your policy whenever you experience a major life change.

In conclusion, no matter which plan of life insurance you choose, it is very important to understand the specific guidelines of each type. Here at LCA Insurance Group, we recommend a no obligation ‘needs assessment’ with one of our brokers. We can assist you and your family with the best options available.

Hospice is a type of medical care that focuses on providing comfort and support to individuals who are facing a terminal illness and are no longer seeking curative treatment. The goal of hospice care is to help patients live their remaining days as comfortably as possible and to provide support to their loved ones during this difficult time.

The Inflation Reduction Act of 2022 includes provisions to lower prescription drug costs for people with Medicare and reduce drug spending by the federal government, while making several changes to the Medicare Part D drug benefit. These changes include a cap on out-of-pocket drug spending for enrollees in Medicare Part D or MAPD ( M edicare A dvantage P rescription D rug) plans and requiring Part D plans and drug manufacturers to pay a greater share of costs for Part D enrollees with high drug costs. This post provides an overview of the Part D benefit design and Part D enrollee cost-sharing changes coming in 2024 and 2025.

Medicare Advantage Plans combine Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. Most Medicare Advantage Plans include drug coverage (Part D). In most cases, you’ll need to use health care providers who participate in the plan’s network. These plans set a limit on what you’ll have to pay out-of-pocket each year for covered services.

You can absolutely secure a life policy for your parents. Doing so will offer substantial financial security for your family. Purchasing the best type of insurance depends on their current health, medical history, age and financial situation. Putting life insurance in place for your parents is a major step in preparation for their passing if they don’t have any coverage already. Even if they do have life insurance, an additional policy can cover funeral expenses for example, while leaving their original policy to cover other costs.

A final expense life policy can offer excellent financial security. It can provide your family with a safety net, making sure they will not be left with a huge financial burden. Whether you are looking for yourself or possibly looking for an insurance policy for your parents , the next logical step then, is to locate the correct type of policy. Fortunately, finding the best Final Expense policy is pretty easy. It shouldn’t take hours of investigating and research. We can actually show you how to accomplish this before your favorite TV sitcom is over. Firstly though, let’s do a little investigating. What makes it the Best Burial Insurance? There are 3 factors to look for in a burial insurance plan. Coverage starts immediately – no waiting period if possible. Policy is competitively priced. Insurance company has a good financial record. Now, let’s take a look at these 3 factors in detail. When does my insurance coverage start? Some burial policies have a two-year waiting period where they will not pay the full death benefit. This type of plan is designed for individuals with severe health conditions, but healthy people still sign up for them. We help people every day that didn’t know they could qualify for something better. Fortunately, the majority of our clients qualify for an immediate coverage plan. Here is the key point- How do you choose the right carrier? Which one has a plan that would allow you to be approved for immediate coverage. This is where the experience of LCA Insurance Group can help you. This step is a critical piece of the process . We can assess your health and medical history to determine eligibility for immediate coverage. We have a full understanding on the underwriting guidelines of these burial insurance carriers. In the end, we can advise you on the best possible option based on your health and budget. Only using a two-year wait policy as a last choice option. The Cost of the Burial Policy Most final expense life insurance companies have a similar cost structure. However, some insurance carriers offer additional benefits that are included with your policy. Examples include an accidental death rider or possibly a nursing home rider. These are items to consider when comparing pricing for the same amount of immediate coverage. Insurance Company Financial Record Thankfully today, most life insurance companies are A rated with A.M. Best . AM Best provides news, credit ratings and financial data products and services for the insurance industry. If an insurance company has financial issues, they may not be able to pay a claim. Consequently, this would cause the very financial hardship you were trying to avoid. Fortunately, with big data and sources like actuarial tables, it’s very unlikely for an insurance company to have financial issues. How do I find the Best Burial Insurance Locate a qualified independent insurance broker or agency. Independent agencies usually have several companies that they work with.

Mortgage Protection or Mortgage Life Insurance is a version of term life insurance ; it is insurance that pays off your home loan if you pass away. This type of policy usually lasts for the same term of time as your loan. Purchasing a house is a sizable financial responsibility. Typically, a mortgage loan is a 30-year commitment. What would transpire if you pass away and couldn’t make the payment? Mortgage protection insurance prevents foreclosure if you were to die while you owe money on your home loan. Financial Burden or Peace of Mind Until your house is paid off, there is a significant financial risk looming. If you can’t make the monthly payments, for example, the lender could foreclose on the mortgage forcing your family out of your home. This is why many homeowners enter a mortgage with someone else – like a spouse or partner. This person can limit the financial risk of buying a home. But what happens if you were to die unexpectedly? Your co-borrower or family would be left with that financial burden. This is where Mortgage Protection offers peace of mind. The policy could pay off the loan all together or help your spouse/partner/family make the monthly payments. Isn’t this just like PMI? No, Mortgage Protection Insurance IS NOT the same as private mortgage insurance . Private Mortgage Insurance is protection for your lender. Some borrowers think that (PMI) will pay off their mortgage when they pass away. This is not true. The mortgage lender usually requires 20% down to eliminate PMI. Otherwise, it would generally be required on a loan. Mortgage Protection Advantages Quick Approval. Mortgage protection insurance is fairly easy to purchase. These policies are considered simplified issue and can be approved quickly. No Medical Exam. Generally, there is no medical exam. These types of policies are more accepting of pre-existing medical conditions and illnesses Easy Add-On. Mortgage protection insurance could be a valuable supplement to the life insurance coverage you may already have in place. With high approval rates, this is a simple way to add coverage for your family. Mortgage Protection Disadvantages Simplified Issue. Coverage may be more expensive for folks in excellent health. Since there is no medical exam, the underwriting steps are less accurate. This means the rates will be more expensive as compared to term life insurance that is fully underwritten. Length of Term. The term of coverage is the length of your mortgage. Once the term is over the policy ends. Coverage Decreases. There is a reduction in coverage as you pay down your principal loan amount. The coverage amount is always in line with the mortgage balance. Beneficiary Choice. The Death benefit (payout) is usually sent directly to the mortgage lender. Final Thoughts If you are in a high-risk career field or if you have health conditions that make life insurance difficult to get, mortgage protection insurance may be a good fit for you. It’s a type of term life insurance policy. If you pass away during that term, the insurance company pays the death benefit directly to the lender. If you out live your policy term, hopefully your house is paid off at that point. Here at LCA Insurance Group, we recommend a no obligation ‘needs assessment’ with one of our brokers. We can assist you in comparing the best options available.