Blog Layout

Can I Buy Life Insurance for my Parents?

websitebuilder • April 7, 2022

You can absolutely secure a life policy for your parents. Doing so will offer substantial financial security for your family. Purchasing the best type of insurance depends on their current health, medical history, age and financial situation.

Putting life insurance in place for your parents is a major step in preparation for their passing if they don’t have any coverage already. Even if they do have life insurance, an additional policy can cover funeral expenses for example, while leaving their original policy to cover other costs.

Why Purchase Life Insurance for Parents

- You need help paying for their final expenses. Most families underestimate funeral costs. Prices can vary widely depending on the type of arrangements; burial or cremation. The National Funeral Directors Association estimates the median cost of a funeral and burial at about $8,500.

- You need help paying their medical bills. Unfortunately, the last few years of a person’s life can often be costly. Some folks require expensive prescriptions or medical treatments; others need more doctor or hospital visits. And a few may need 24-hour care. These medical expenses can be difficult to handle.

- You need help handling their real estate. The process of selling their home and moving a surviving parent can cost thousands of dollars. Adult children today will move their surviving parent closer or move them into an assisted living community.

Reality of Purchasing Life Insurance for your Parents

Let’s face it, we buy life insurance to safeguard our family. We want keep them from going through a financial hardship when we die. In the same vein, by having insurance to cover our parents, this would protect us from unexpected costs that could influence our financial stability.

When a parent passes, the surviving family members may not be able to cover their final expenses. Bills and debts plus the money required to cover funeral expenses can be a real hardship.

When a parent passes, the surviving family members may not be able to cover their final expenses. Bills and debts plus the money required to cover funeral expenses can be a real hardship.

Questions to ask

The following questions can clarify your goals in protecting your family when your parents die:

Whoever the owner of the policy is, make sure they understand their obligations.

- What is the goal of the policy – What specifically will the proceeds of the policy pay for, have a detailed plan in mind

- What kind of policy – Permanent or temporary coverage? Before choosing, it’s critical to understand the details on how each policy works. For instance, if a policy is less expensive than another does not mean it is the optimum plan for you.

- How much coverage is needed – The average cost of a funeral can be $10,000 or more. Moreover, any other debt or final expense such as unpaid medical bills should be included for an accurate coverage amount.

- Who will own and pay for the policy – Each situation is unique. Your state of affairs will establish who is the best owner. Generally, you’ll need consent from your parents to buy a policy for them. Likewise, the person making the payments is normally the owner.

Whoever the owner of the policy is, make sure they understand their obligations.

What Type of Life Insurance is Best for Parents?

With younger folks, a term policy is usually the go to. Term insurance is typically cheaper for higher coverage amounts since most people will outlive the policy. A term policy usually lasts for 10, 20 or 30 yrs and normally requires a medical exam to qualify.

Whole life insurance is the most popular option for ageing parents with adult children. It’s best suited for folks 55-85 that are near or in retirement. This type of policy builds cash value and has no expiration date. Most often, you can be approved without a medical exam. The premium payments are based on age and health. So, the younger/healthier they are when the policy starts, the less expensive the payment will be.

One specialized type of whole life insurance is called Final Expense Insurance. It is specifically designed to cover final expenses and any other end of life costs.

Whole life insurance is the most popular option for ageing parents with adult children. It’s best suited for folks 55-85 that are near or in retirement. This type of policy builds cash value and has no expiration date. Most often, you can be approved without a medical exam. The premium payments are based on age and health. So, the younger/healthier they are when the policy starts, the less expensive the payment will be.

One specialized type of whole life insurance is called Final Expense Insurance. It is specifically designed to cover final expenses and any other end of life costs.

How much Coverage do I need?

Every situation is unique. Factors to consider for your parents –

- What are their monthly expenses

- Is there medical bills that are due

- What is their total debt

- How much is their funeral services

What determines the Cost?

Age and health are major factors for the insured. Term insurance is generally the best option for younger folks but is harder to “make the grade” for since most insurers require a medical exam.

On the other hand, whole life plans usually have a higher payments, but include features that term policies lack. These include building a cash value and no expiration date.

Tip to keep insurance costs down To help keep costs down, get insurance when your young, before your health or age can cause a higher premium. As a result, you will lock in an affordable payment even if your health changes later in life. In the end, these factors along with the amount of coverage will determine the cost.

On the other hand, whole life plans usually have a higher payments, but include features that term policies lack. These include building a cash value and no expiration date.

Tip to keep insurance costs down To help keep costs down, get insurance when your young, before your health or age can cause a higher premium. As a result, you will lock in an affordable payment even if your health changes later in life. In the end, these factors along with the amount of coverage will determine the cost.

Here is an example quote for a Final Expense Insurance Policy -

- Healthy Male Age 50 $10,000.00 in Coverage $30.51 a month

- ‘Not so’ Healthy Male Age 65 $10,000.00 in Coverage $81.33 a month

In this illustration you can see the substantial difference in the payment based on the age and health of the proposed insured.

Final Thoughts

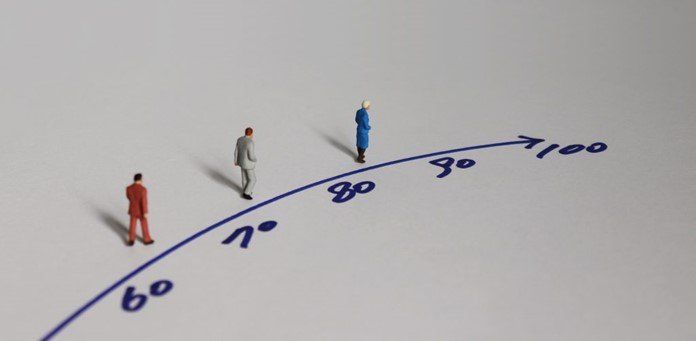

Who wants to envision the passing of their parents; no one … however data shows that parents will probably pass before their children. This frequently means a close family member, usually a child; has to arrange the services and cover the financial costs involved.

Purchasing life insurance for your parents is a caring and considerate choice. As a result, it would ensure that the funds are there to take care of their final wishes.

Purchasing life insurance for your parents is a caring and considerate choice. As a result, it would ensure that the funds are there to take care of their final wishes.

June 23, 2023

Hospice is a type of medical care that focuses on providing comfort and support to individuals who are facing a terminal illness and are no longer seeking curative treatment. The goal of hospice care is to help patients live their remaining days as comfortably as possible and to provide support to their loved ones during this difficult time.

June 23, 2023

The Inflation Reduction Act of 2022 includes provisions to lower prescription drug costs for people with Medicare and reduce drug spending by the federal government, while making several changes to the Medicare Part D drug benefit. These changes include a cap on out-of-pocket drug spending for enrollees in Medicare Part D or MAPD ( M edicare A dvantage P rescription D rug) plans and requiring Part D plans and drug manufacturers to pay a greater share of costs for Part D enrollees with high drug costs. This post provides an overview of the Part D benefit design and Part D enrollee cost-sharing changes coming in 2024 and 2025.

September 23, 2022

Medicare Advantage Plans combine Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. Most Medicare Advantage Plans include drug coverage (Part D). In most cases, you’ll need to use health care providers who participate in the plan’s network. These plans set a limit on what you’ll have to pay out-of-pocket each year for covered services.

By websitebuilder

•

March 24, 2022

A final expense life policy can offer excellent financial security. It can provide your family with a safety net, making sure they will not be left with a huge financial burden. Whether you are looking for yourself or possibly looking for an insurance policy for your parents , the next logical step then, is to locate the correct type of policy. Fortunately, finding the best Final Expense policy is pretty easy. It shouldn’t take hours of investigating and research. We can actually show you how to accomplish this before your favorite TV sitcom is over. Firstly though, let’s do a little investigating. What makes it the Best Burial Insurance? There are 3 factors to look for in a burial insurance plan. Coverage starts immediately – no waiting period if possible. Policy is competitively priced. Insurance company has a good financial record. Now, let’s take a look at these 3 factors in detail. When does my insurance coverage start? Some burial policies have a two-year waiting period where they will not pay the full death benefit. This type of plan is designed for individuals with severe health conditions, but healthy people still sign up for them. We help people every day that didn’t know they could qualify for something better. Fortunately, the majority of our clients qualify for an immediate coverage plan. Here is the key point- How do you choose the right carrier? Which one has a plan that would allow you to be approved for immediate coverage. This is where the experience of LCA Insurance Group can help you. This step is a critical piece of the process . We can assess your health and medical history to determine eligibility for immediate coverage. We have a full understanding on the underwriting guidelines of these burial insurance carriers. In the end, we can advise you on the best possible option based on your health and budget. Only using a two-year wait policy as a last choice option. The Cost of the Burial Policy Most final expense life insurance companies have a similar cost structure. However, some insurance carriers offer additional benefits that are included with your policy. Examples include an accidental death rider or possibly a nursing home rider. These are items to consider when comparing pricing for the same amount of immediate coverage. Insurance Company Financial Record Thankfully today, most life insurance companies are A rated with A.M. Best . AM Best provides news, credit ratings and financial data products and services for the insurance industry. If an insurance company has financial issues, they may not be able to pay a claim. Consequently, this would cause the very financial hardship you were trying to avoid. Fortunately, with big data and sources like actuarial tables, it’s very unlikely for an insurance company to have financial issues. How do I find the Best Burial Insurance Locate a qualified independent insurance broker or agency. Independent agencies usually have several companies that they work with.

By websitebuilder

•

April 30, 2021

Mortgage Protection or Mortgage Life Insurance is a version of term life insurance ; it is insurance that pays off your home loan if you pass away. This type of policy usually lasts for the same term of time as your loan. Purchasing a house is a sizable financial responsibility. Typically, a mortgage loan is a 30-year commitment. What would transpire if you pass away and couldn’t make the payment? Mortgage protection insurance prevents foreclosure if you were to die while you owe money on your home loan. Financial Burden or Peace of Mind Until your house is paid off, there is a significant financial risk looming. If you can’t make the monthly payments, for example, the lender could foreclose on the mortgage forcing your family out of your home. This is why many homeowners enter a mortgage with someone else – like a spouse or partner. This person can limit the financial risk of buying a home. But what happens if you were to die unexpectedly? Your co-borrower or family would be left with that financial burden. This is where Mortgage Protection offers peace of mind. The policy could pay off the loan all together or help your spouse/partner/family make the monthly payments. Isn’t this just like PMI? No, Mortgage Protection Insurance IS NOT the same as private mortgage insurance . Private Mortgage Insurance is protection for your lender. Some borrowers think that (PMI) will pay off their mortgage when they pass away. This is not true. The mortgage lender usually requires 20% down to eliminate PMI. Otherwise, it would generally be required on a loan. Mortgage Protection Advantages Quick Approval. Mortgage protection insurance is fairly easy to purchase. These policies are considered simplified issue and can be approved quickly. No Medical Exam. Generally, there is no medical exam. These types of policies are more accepting of pre-existing medical conditions and illnesses Easy Add-On. Mortgage protection insurance could be a valuable supplement to the life insurance coverage you may already have in place. With high approval rates, this is a simple way to add coverage for your family. Mortgage Protection Disadvantages Simplified Issue. Coverage may be more expensive for folks in excellent health. Since there is no medical exam, the underwriting steps are less accurate. This means the rates will be more expensive as compared to term life insurance that is fully underwritten. Length of Term. The term of coverage is the length of your mortgage. Once the term is over the policy ends. Coverage Decreases. There is a reduction in coverage as you pay down your principal loan amount. The coverage amount is always in line with the mortgage balance. Beneficiary Choice. The Death benefit (payout) is usually sent directly to the mortgage lender. Final Thoughts If you are in a high-risk career field or if you have health conditions that make life insurance difficult to get, mortgage protection insurance may be a good fit for you. It’s a type of term life insurance policy. If you pass away during that term, the insurance company pays the death benefit directly to the lender. If you out live your policy term, hopefully your house is paid off at that point. Here at LCA Insurance Group, we recommend a no obligation ‘needs assessment’ with one of our brokers. We can assist you in comparing the best options available.

Content, including images, displayed on this website is protected by copyright laws. Downloading, republication, retransmission or reproduction of content on this website is strictly prohibited. Terms of Use

| Privacy Policy